Priming the Deal Through Target Audiences

By Eric Seidel, CEO

The Media Trainers®

A very important vote’s scheduled for this Tuesday (July 21st) at the NRG Energy stockholder meeting. Utility holding company Exelon has its own slate of directors up for election to the NRG board. Exelon has been on a months-long campaign to buy NRG and keeps getting turned away.

But the door remains open. Exelon has continually increased its offer, and NRG has indicated the latest proposal this month was a “step in the right direction.”

Of course, Exelon wants and needs the blessing of a majority of NRG shareholders and their help to increase Exelon’s influence on NRG’s board of directors. And, it’s those stockholders Exelon has been targeting, including in one of the company’s latest opportunities placing Chairman and CEO John Rowe on CNBC:

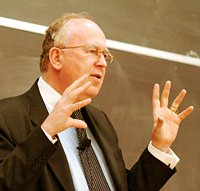

Exelon CEO John Rowe

“…we think the synergies that we can offer…make a couple billion dollars for the

shareholders in each company, and that’s a rare thing. NRG is betting on a

growth strategy. Most of those growth strategies in our business don’t work…this

is not only a conflict about price, it’s a conflict about views of the entire

industry and it really just comes down to what the investors believe.”

NRG is a global wholesale energy company. Exelon is the most prolific user of nuclear power producing electricity in America. NRG has nuclear generation facilities in the very attractive growth market of Texas, as well as natural gas, oil and coal plants throughout North America and in Europe and Austrailia.

Together, the two companies would create the largest U.S. power generating concern. When Rowe talks about making “a couple billion dollars for the shareholders in each company” on CNBC, it’s a very persuasive argument targeted at industry analysts, the NRG board and stockholders he needs in favor of the merger. (Click on video below for the key segment of the interview.)